In a landmark development for Africa’s small and medium-sized enterprises (SMEs), Oze, the Ghana-based fintech platform, has secured significant funding from global giants Visa and DEG (German development finance institution). This strategic investment marks a turning point for Oze and underscores the growing confidence in Africa’s digital economy.

The announcement of Oze landing funding has sent ripples across the tech and financial sectors. With Visa and DEG backing the platform, Oze is poised to scale its operations and empower millions of SMEs across the continent. This move is not just a win for Oze but a testament to the potential of African innovation.

Why Oze Lands Funding is a Game-Changer

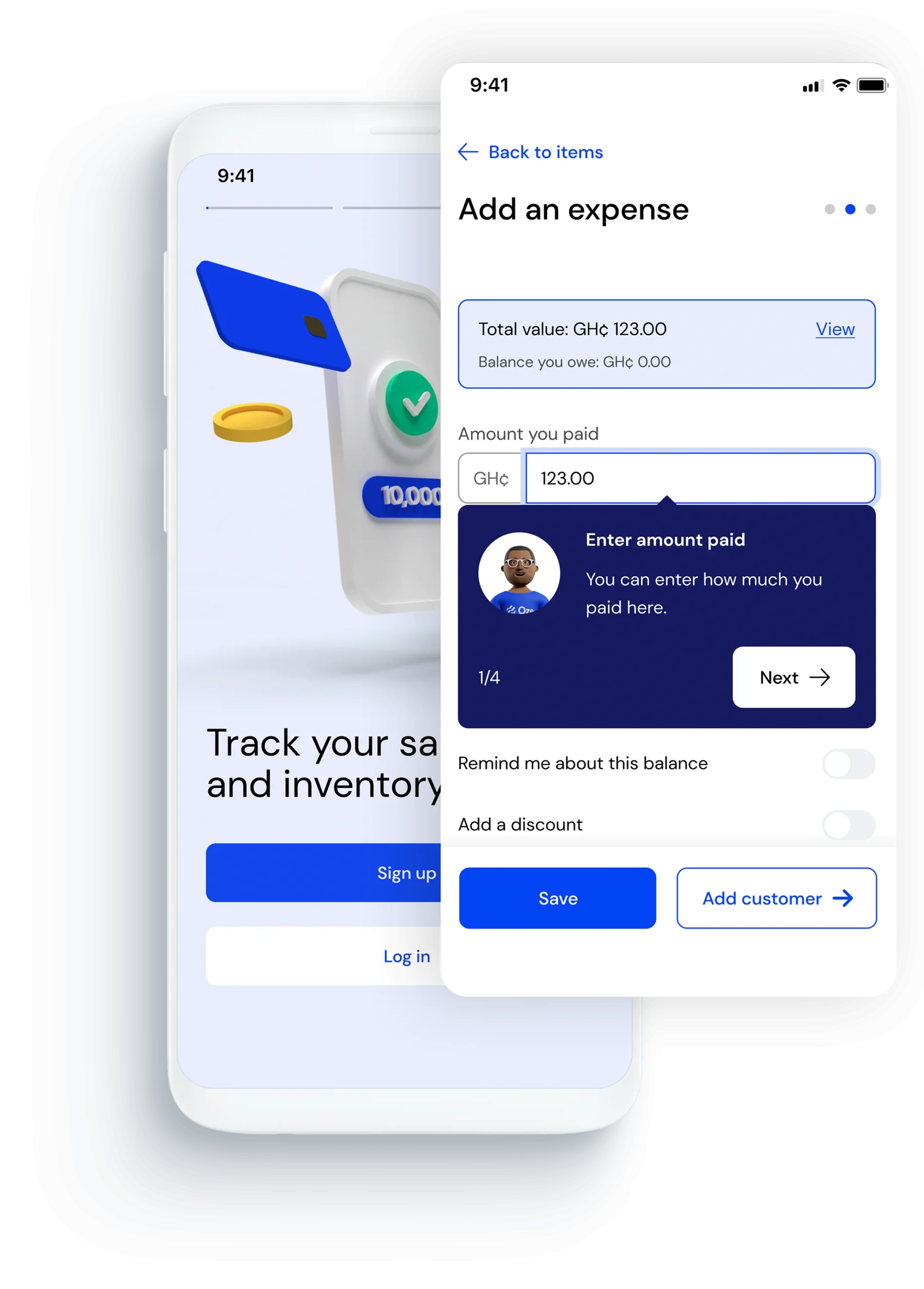

Oze, founded in 2018, is on a mission to empower African SMEs with the tools they need to grow. Oze specializes in AI-driven digital lending, enabling banks, microfinance institutions, and fintech to offer unsecured loans to small businesses. The funding will accelerate the expansion of its Lending Management System (LMS) across more markets. This technology unlocks financial opportunities for millions of SMEs, driving sustainable development.

The investment follows Oze’s participation in the Visa Accelerator Program, where it was one of the first startups to receive backing. This program supports top African fintech startups with mentorship and growth resources. Oze operates in several countries, including Ghana, Nigeria, Guinea, Benin, Rwanda, Madagascar, Zimbabwe, and Lesotho, with plans to expand further.

Related: Flutterwave to List Shares on NGX

What Visa and DEG Bring to the Table

Visa, a global leader in digital payments, and DEG, a prominent development finance institution, bring more than just capital. Their expertise, networks, and resources will be invaluable as Oze scales its operations.

Visa’s involvement signals a strong belief in Oze’s vision to digitize African SMEs. DEG’s participation highlights the potential for developing Oze’s platform. Together, they provide the perfect blend of financial muscle and strategic support.

Also read: Raenest Secures $11M Series A to Boost African Businesses

The Impact on African SMEs

With the new investment, the fintech hopes to broaden the scope of its LMS, allowing banks, microfinance organizations, and fintech to provide small businesses with digital loans that don’t require collateral. Oze’s patented credit risk algorithm, which analyzes business performance data to improve lending decisions, powers the system.

Oze’s funding comes at a critical time for African SMEs. These businesses are the backbone of the continent’s economy, yet they often struggle with access to finance and operational inefficiencies.

With this new funding, Oze can address these challenges head-on. The platform will offer SMEs better access to credit, improved financial management tools, and valuable insights to drive growth. This will benefit individual businesses and contribute to economic development across the continent.

Related: Tech Adoption in Kenya: A Transformative Journey

A Catalyst for Digital Transformation

Oze’s funding is more than just a financial milestone. It’s a catalyst for digital transformation in Africa. By equipping SMEs with digital tools, Oze is helping to bridge the gap between informal and formal economies.

This funding will enable Oze to innovate further, introducing new features and services tailored to the needs of African entrepreneurs. It’s a step toward a more inclusive, digitally driven economy.

Also read: African Schools Embrace the AI Revolution

What’s Next for Oze?

With Oze’s funding, the company is gearing up for an exciting growth phase. The immediate focus will be expanding its user base and enhancing its platform’s capabilities.

Oze also plans to forge strategic partnerships with financial institutions, governments, and other stakeholders. These collaborations will amplify its impact and create a more supportive ecosystem for SMEs.

Oze’s funding from Visa and DEG is a shining example of Africa’s tech potential. It highlights the growing interest of global players in the continent’s digital economy.

For Oze, this is just the beginning. The funding will fuel its mission to empower SMEs, drive economic growth, and transform lives. For Africa, it’s a reminder that the future is digital—and the possibilities are endless.

Related: Starlink Expands in Africa: A New Ground Station in Nairobi